Medicare 101: Helping You Understand the Basics to Protect Your Future

-

Last Updated July 19, 2025

Approaching retirement age brings a mix of excitement and uncertainty. As we prepare to bid farewell to the workforce, thoughts naturally turn to securing our financial future and managing healthcare needs in our golden years. Retirement isn't just about leisure; it's about ensuring our well-being as we age.

But what happens if you get sick once you’re older? How do you pay for your healthcare needs when you no longer have insurance through an employer? That’s where Medicare comes into play. In this article, we’ll help you understand the basics to ensure you’re in the know when the time comes.

What is Medicare?

To explain it simply, Medicare is the federal health insurance program designed to provide coverage for:

-

Individuals who have reached age 65 or are older

-

Certain younger people with disabilities

-

Those diagnosed with End-Stage Renal Disease (ESRD), which is permanent kidney failure that requires dialysis or a transplant

In 1965, the passage of the Social Security Amendments, commonly known as Medicare and Medicaid, established a comprehensive program of health insurance. This legislation created one basic program for individuals aged 65 and older and another to provide health insurance for people with limited income, funded by state and federal sources.

Medicare Part A (Hospital Insurance):

-

Covers hospital stays for inpatient care

-

Covers the cost of care should you require a stay in a skilled nursing facility

-

Hospice care

-

Some home healthcare

Medicare Part B (Medical Insurance):

-

Covers various physician services

-

Medical supplies

-

Outpatient care

-

Preventive services

Medicare Part D (Prescription Drug Coverage):

-

Helps provide coverage for the cost of prescription drugs

-

Includes coverage for many recommended vaccinations or shots

- Click here to view our comprehensive guide on Medicare Part D

When am I Eligible for Medicare?

Your first chance to sign up for Medicare is during your Initial Enrollment Period, which we’ll discuss a bit further in the next section. This period typically begins when you turn 65. For instance, if your birthday is on March 1st, your Initial Enrollment Period would run from December to June. It spans seven months, starting three months before your 65th birthday and ending three months after the month you turn 65. Learn more in our blog article about Medicare Enrollment Periods.

For example, if you sign up in December, January, or February, your coverage starts on March 1st. This period ensures you have ample time to enroll in Medicare and avoid any gaps in coverage as you transition into this important phase of life.

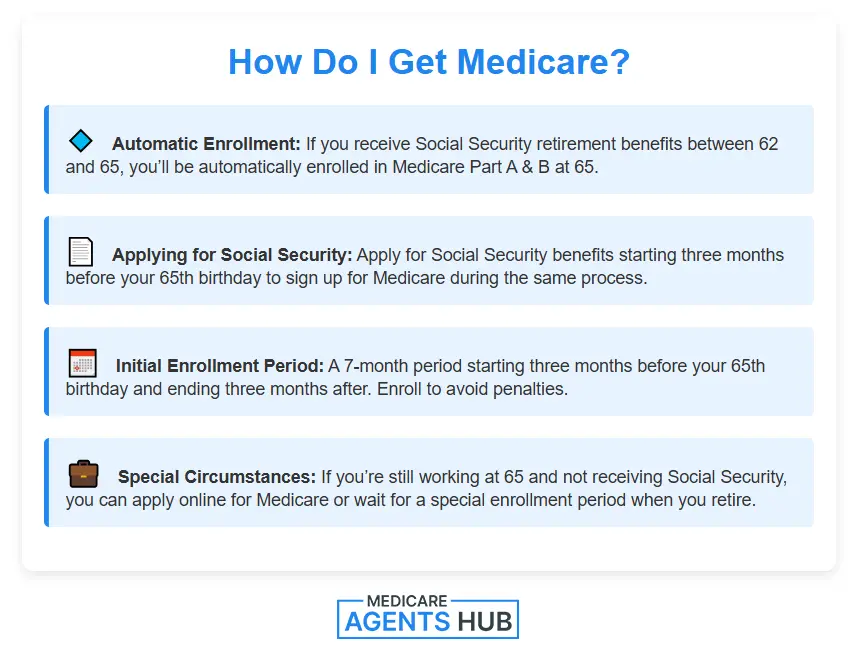

How Do I Get Medicare?

Enrolling in Medicare is relatively easy, and there are several ways to do it:

-

Automatic Enrollment: If you start receiving Social Security retirement benefits anytime between the age of 62 and up to four months before turning 65, you'll be enrolled automatically in Medicare Part A and Part B when you reach 65.

-

Applying for Social Security: If you apply for Social Security benefits three months before your 65th birthday or later, you can sign up for Medicare during the same process.

-

Initial Enrollment Period: This 7-month period begins three months before you turn 65 and ends three months after your 65th birthday. It's crucial to enroll during this time to avoid any penalties.

-

Special Circumstances: If you're not ready to receive Social Security benefits at 65 because you're still working, you can apply online for Medicare only. Alternatively, you may wait until you retire to sign up during a special enrollment period.

What Does Medicare Cover?

While specifics can vary based on your plan, all Medicare plans must offer at least the same coverage as Original Medicare. However, certain services may have limitations, such as being available only in specific facilities or for patients with particular conditions.

Medicare coverage is determined by three key factors:

-

Federal and state laws establish the basic framework for Medicare coverage.

-

National coverage decisions made by Medicare dictate whether certain services are covered under the program.

-

Local coverage decisions, handled by companies processing Medicare claims in each state, determine the medical necessity of services within their respective areas.

In general, Medicare Part A covers:

-

Inpatient care in hospitals

-

Skilled nursing facility care

-

Hospice care

-

Home health care

Medicare Part B covers two types of services:

-

Medically necessary services: Diagnostic and treatment services meeting accepted medical standards.

-

Preventive services: Healthcare aimed at preventing or detecting illnesses early, including flu shots.

Part B also covers a range of services such as clinical research, ambulance services, durable medical equipment, mental health care, and various outpatient programs. Additionally, most preventive services obtained from in-network providers come at no cost to the patient.

How Much Does Medicare Cost?

If you are wondering about how much Medicare costs, you should know that Medicare requires you to pay a monthly premium and a portion of the costs for each covered service you receive. Unlike many private insurance plans, there's no annual cap on out-of-pocket expenses, unless you have supplemental coverage like a Medicare Supplement Insurance (Medigap) policy or a Medicare Advantage Plan.

For Part A, most individuals pay a $0 premium, but there's a deductible of $1,632 for each hospital admission per benefit period. Part B premiums typically start at $174.70 per month, subject to income-based adjustments, and the annual deductible is $240. Part D (prescription drug coverage) and Medicare Advantage Plan (Part C) premiums vary depending on the plan you choose and may be subject to income-based surcharges.

It's important to note that these costs can change annually, so staying informed about updates to Medicare premiums and deductibles is essential for budgeting your healthcare expenses effectively. Additionally, you must continue paying your Part B premium to remain enrolled in a Medicare Advantage Plan.

Need Help Understanding Your Medicare Benefits?

Remember, Medicare eligibility typically starts at age 65, but enrollment periods and coverage options vary. Be sure to enroll during your Initial Enrollment Period to avoid penalties. Additionally, knowing the costs associated with Medicare and available supplemental coverage options can help you plan for your healthcare expenses effectively.

For personalized guidance on navigating Medicare options, we always recommend seeking guidance from a local Medicare insurance agent licensed in your state. To learn more about Medicare and the roles of Medicare agents, please browse our other resources that will help you to make informed decisions about your Medicare coverage. Your health and financial well-being are our top priorities.

Frequently Asked Questions

What is a simple definition of Medicare?

Medicare is a federal health insurance program primarily for people aged 65 and older, individuals with certain disabilities, and those with end-stage renal disease. It provides coverage for various medical services, including hospital stays, doctor visits, and prescription drugs, helping beneficiaries afford essential healthcare.

What is covered under Medicare Part A?

Medicare Part A, also known as hospital insurance, covers essential inpatient hospital care, skilled nursing facility stays, hospice care, as well as a range of medical services including lab tests, surgeries, and home health care. It ensures beneficiaries have access to necessary hospital and related services, providing financial protection for these vital healthcare needs.

What is covered under Medicare Part B?

Medicare Part B covers medically necessary services and preventive care. This includes services or supplies essential for diagnosing or treating medical conditions according to accepted medical standards. Additionally, Part B includes preventive healthcare such as flu shots and screenings to prevent illnesses or detect them early when treatment is most effective. It ensures beneficiaries have access to essential medical services for maintaining their health and well-being.

What is the Medicare Advantage Plan?

A Medicare Advantage Plan, also known as Medicare Part C, offers an alternative to Original Medicare (Parts A and B) through private insurance plans approved by Medicare. These plans provide all Part A and Part B benefits, often including additional coverage, such as prescription drugs, dental, vision, and hearing services. Medicare Advantage Plans typically have network restrictions and may require copayments or coinsurance for services.

What is covered under Medicare Part D?

Medicare Part D provides prescription drug coverage, helping beneficiaries afford necessary medications. Private insurance plans approved by Medicare offers part D plans. Covered medications include both brand-name and generic drugs prescribed by a doctor. However, coverage specifics may vary between plans, so it's essential to review the formulary, or list of covered drugs, to ensure your medications are included. Part D helps mitigate the high costs of prescription medications for Medicare beneficiaries.

How can I benefit from a local Medicare insurance agent?

Finding a local Medicare insurance agent is integral to retirement and financial planning. They assist individuals in selecting policies tailored to their unique needs. While various types of Medicare insurance agents exist, choosing one well-versed in policy benefits is essential. Independent Medicare brokers, particularly advantageous, offer policies from multiple insurers. This enables them to compare coverage options and find the best fit, considering the individual's medical requirements and budget.