The Pros and Cons of Medicare Supplement Insurance

-

Last Updated April 1, 2025

Written by Tammy Burns

Medicare Broker Licensed in MS, AL, GA & 1 other states

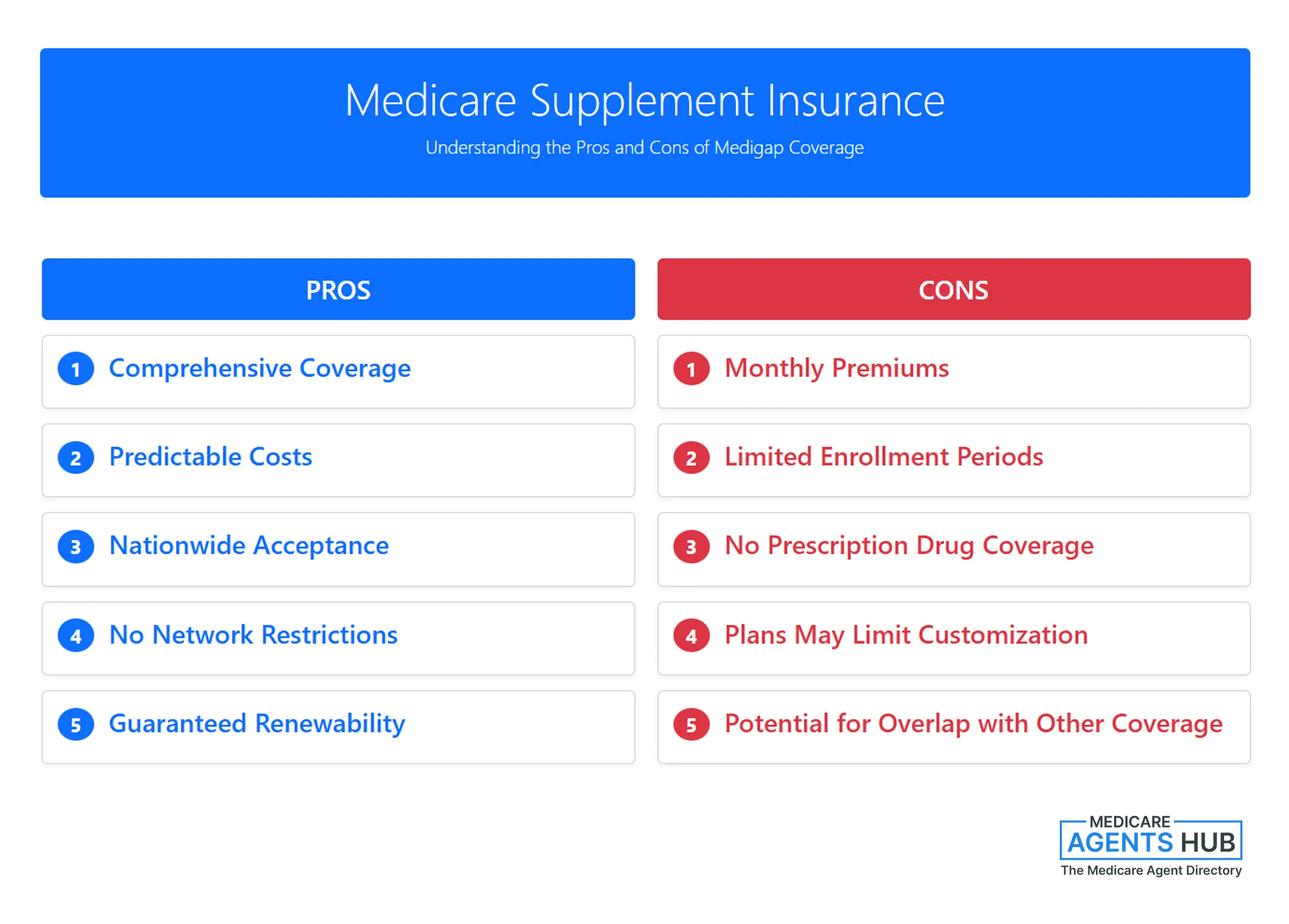

Medicare Supplement Insurance, commonly known as Medigap Insurance, is designed to help cover some of the out-of-pocket costs associated with Original Medicare (Parts A and B). While Medigap can offer valuable benefits, it's essential to weigh its pros and cons before deciding whether it's the right choice for you.

What is Medicare Supplement Insurance?

Medigap plans are sold by private insurance companies and are intended to fill the gaps in Original Medicare coverage. These plans can help pay for deductibles, copayments, and coinsurance, making healthcare costs more predictable.

Pros of Medicare Supplement Insurance

1. Comprehensive Coverage

Medigap plans offer extensive coverage options. Depending on the plan you choose, you can benefit from coverage for hospital stays, doctor visits, preventive services, and more. Some plans cover services that Original Medicare doesn't, like emergency care when traveling abroad.

2. Predictable Costs

With a Medigap policy, many of the out-of-pocket costs associated with Medicare are covered, which means you can budget more effectively for your healthcare expenses. This predictability can provide peace of mind, especially for those with ongoing medical needs.

3. Nationwide Acceptance

Medigap policies are widely accepted by healthcare providers throughout the United States. Since these plans work alongside Original Medicare, you can see any doctor or specialist who accepts Medicare, giving you flexibility in your healthcare choices.

4. No Network Restrictions

Unlike Medicare Advantage plans, which may have limited networks of providers, Medigap plans do not require you to use specific doctors or facilities. This can be especially beneficial if you have a preferred provider or require specialized care.

5. Guaranteed Renewability

Most Medigap policies are guaranteed renewable as long as you pay your premiums. This means that your coverage cannot be canceled due to health issues, providing long-term security.

Cons of Medicare Supplement Insurance

1. Monthly Premiums

Medigap plans come with an additional monthly premium, which can be a significant cost on top of your Medicare Part B premium. These costs can vary widely based on the plan and your location, so it's essential to consider your budget.

2. Limited Enrollment Periods

You can only purchase a Medigap policy during specific enrollment periods, primarily during your Medigap Open Enrollment Period (the 6 months after you turn 65 and are enrolled in Medicare Part B). Outside of this period, you may face medical underwriting, which could affect your ability to obtain coverage or result in higher premiums.

3. No Prescription Drug Coverage

Most Medigap plans do not include prescription drug coverage. If you want medication coverage, you’ll need to enroll in a separate Medicare Part D plan, which adds to your overall healthcare costs.

4. Standardized Plans May Limit Customization

Medigap plans are standardized by the government into different lettered plans (A through N), each offering a specific set of benefits. While this standardization can simplify the decision-making process, it may not allow for the flexibility to tailor coverage to your specific needs.

5. Potential for Overlap with Other Coverage

If you have other health insurance (such as from an employer), you may find that a Medigap policy overlaps with your existing coverage, leading to unnecessary costs. It’s crucial to evaluate your current health insurance options before enrolling in a Medigap plan.

Conclusion

Medicare Supplement Insurance can provide valuable financial protection and peace of mind for those navigating the complexities of healthcare costs. However, it’s essential to consider both the advantages and drawbacks before enrolling. Assess your health needs, budget, and existing coverage to determine if a Medigap policy is the right fit for you. Consulting with a licensed insurance agent or a Medicare expert can also help you make an informed decision tailored to your specific circumstances.

Tammy Burns is a Medicare Broker with Bobby Brock Insurance. Tammy is licensed in MS, AL, GA, KY, PA, TN, TX, and VA.